Welcome back to Overlooked and Undervalued. For this writeup, I’ve used a slightly longer format. After introducing the business and the opportunity, I’m going to discuss three longstanding issues. I’ll then continue in the normal way - looking at the management team, the valuation, and the risks. As always, please add your comments at the bottom.

I’m a sucker for long histories. I like to look back across many different market environments, trying to ascertain the durability or resilience of a business. Those who think along similar lines will not be disappointed. Titon Holdings is one of the oldest public companies I’ve researched, having been listed on the London Stock Exchange since 1988.

For decades, Titon has survived but never really thrived - as the below price chart demonstrates.

Thankfully, Titon’s future looks much brighter, especially if you’re a minority shareholder. After some activist intervention, there’s now a completely new board, who have set about resolving multiple past issues. The results of which are unlocking a hidden and growing profit stream.

Founded in 1972 and listed on the London Stock Exchange in 1988, Titon Holdings manufactures and distributes ventilation products. It has its headquarters in Colchester, Essex and owns a factory in Haverhill, Suffolk (near Cambridge). Approximately 75% of sales are made within the UK, with the remainder split between Europe and North America.

In the past, consolidated results were dominated by the Window and Door Hardware division. Titon’s original founder, John Anderson, is credited with bringing the first Trickle Vent to the UK. This useful form of natural ventilation sits above a window and provides airflow into a building.

Today, Trickle Vents account for roughly two thirds of sales within the Window and Door Hardware division. The remainder coming from related products such as hinges and locks.

Titon’s customers are window fabricators based in the UK (of which there are thousands). As you might expect, this is a fairly commoditised and low margin business. Yet, Titon has an established position at the higher end, producing quality products for fabricators that want custom sizes and colours.

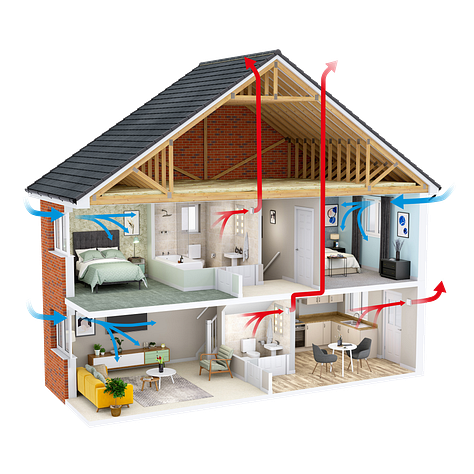

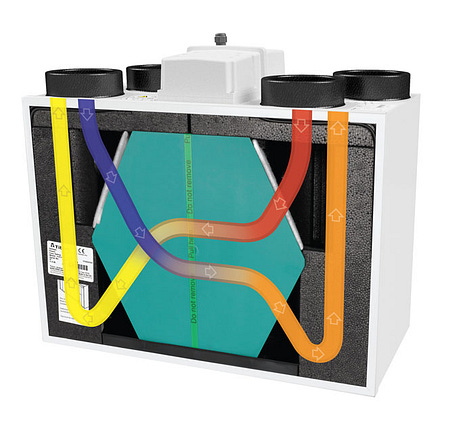

The other division, called Mechanical Ventilation, manufactures ‘whole-house ventilation systems’ that provide continuous airflow around a home. Titon began manufacturing this more sophisticated form of ventilation in the mid 2000s and Mechanical Ventilation officially became a new division in 2012.

The most basic type, called Continuous Mechanical Ventilation, costs around £500 per unit and more advanced models, which also provides heat recovery, cost around £1,500 per unit. Titon manufactures the entire ventilation system, including accessories such as Ducting and Air Bricks.

The UK constitutes ~70% of sales. Products are aimed at new buildings (predominantly multi dwelling residential) where Titon sells directly to building contractors working on behalf of major construction companies. Management estimate around half of new buildings use the cheaper Continuous Ventilation and around 20% use heat recovery (the remaining 30% use Natural Ventilation).

The Mechanical Ventilation market (new build multi-dwelling) is dominated by two companies. The largest is Vent-Axia, owned by the UK listed Volution Group (ticker FAN) with an estimated market share of ~40%. Second, is the private company Nuaire, owned by the Genuit Group, with ~20%. Titon is one of three smaller players (the others are Zehnder and EnviroVent) and has a market share of just under 10%.

The opportunity

The Mechanical Ventilation division is Titon’s crown jewel asset. Despite lots of noise in the consolidated results, which indicate low profitability and stalling growth, this division is on an upward trajectory. Sales from Mechanical Ventilation have grown consistently from ~£2 million in 2012 to almost £10 million in 2023 at a 13 % annualised growth rate.

As I’ll discuss later, Mechanical Ventilation has much higher margins than Window and Door Hardware. It also has a longer growth runway, driven by increasing clean air regulation and consumer choices around healthier living.

This growth, the long runway, and the potential profitability have been easily dismissed by investors. Mainly, because of the following three issues.

Issue 1: The failed Korean expansion.

In 2008, Titon entered into a Joint Venture in South Korea, selling its Natural Ventilation products across the country. This worked well for a while and became a profitable addition to the business. However, when the market rapidly shifted towards Mechanical Ventilation, Titon’s management decided not to compete.

As the below chart shows, sales quickly dropped and the Korean business started to lose money. Instead of pulling out, very little action was taken for years, which further exacerbated the problem.

Issue 2: A large and expensive board

Up until very recently, Titon was a family run business. Both the board and the shareholder register was dominated by two families - the Anderson’s and the Richie’s. Together, they controlled the board by occupying both the Chair and Deputy Chair positions. Even when the original founder, John Anderson, retired as Deputy Chair in 2022, he was replaced by his son Tyson Anderson.

For a company of Titon’s size, I’d expect the board to consist of a CEO, CFO, a single Chair, and a few non-execs. Yet, at one point Titon’s board consisted of a CEO, CFO, Chair, Deputy Chair, IT Director and 4 non-execs! An expensive choice, which meant board salaries ballooned to over £700k. A large proportion of which, around £270k, went to the family shareholders i.e. the Chair and Deputy Chair.

Furthermore, Titon has a long history of hoarding cash in order to consistently pay dividends (and salaries). In recent years, as results deteriorated, both families seemed more interested in maximising their income rather than shareholder returns.

Issue 3: Low Profitability.

Unfortunately, segment profitability is not broken out in the annual report and recent consolidated results have been sporadic. Yet prior to 2020, Titon had a long history of maintaining fairly stable Gross Margins of ~25-30% and Operating Margins of ~6%.

As for the future, Mechanical Ventilation has the potential to grow and will eventually dominate Titon’s results. For some idea of the potential profitability, I took a closer look at what competitors within the same industry are earning.

(Some caution is advised here. As with any comparison, it’s far from perfect. Volution is a much larger public company and EnviroVent primarily competes in the parallel industry of Social Housing.)

A new management team is resolving these issues

For meaningful change, it required an activist shareholder, Harwood Capital, building a nearly 30% stake in the company. After three CEO’s in the same number of years, we’re finally seeing real progress under Tom Carpenter, who joined in April 2024.

The first issue (the failed Korean expansion) is close to a resolution. A sale of the entire Korean business has been agreed, thereby removing this loss making entity and cleaning up the organisational structure.

The second issue (a large and expensive board) has been resolved. Both the Richie and Anderson families have relinquished control and instead of two Chairs (Executive and Deputy) there’s now a single Non-Exec Chair. There’s also been a reduction in the number of Non-Exec Directors from 4 to 2. Taken together, I’d estimate these changes reduce board salaries significantly, from over £700k in 2022 to ~£400k going forward.

The third issue (low profitability) will take time. The new management team believe that Titon can earn margins that are similar to their competitors. On a recent call, they stated that Gross Margins’s should be in the ‘mid 30s to low 40s’ for Mechanical Ventilation and ‘mid 20s’ for Window and Door Hardware. A mix that’s expected to drive Operating Margins towards 10%.

To achieve this, the new management team are reducing SKUs, focusing only on products with the highest margins. They are also simplifying the product offering to make the buying process easier for customers. Within Window and Door Hardware, Aluminium windows have been identified as having lower competition than PVC, giving Titon the best opportunity to differentiate. For Mechanical Ventilation the management team is assessing a move into the Social Housing sector, which has traditionally grown faster and earned higher margins than Titon’s current markets.

An early sign of confidence has been the recent insider buying. Last month, the new Non-Exec Chair, Jamie Brooke, purchased ~106k shares and the new CEO, Tom Carpenter, purchased ~66k shares, both at around the current price.

Potential earnings

At 80p per share, the current Market Capitalisation is ~£9 million. Including Net Cash of ~£2 million, the Enterprise Value is ~£7 million. Going forward, I’d estimate normalised sales to be ~£25 million and Operating Margins will reach ~8%. At this point, Titon would be earning an Operating Profit of ~£2 million per year.

Whilst we wait, the downside is well protected. Net Current Asset Value is ~£7 million and Tangible Book Value is ~£13 million. In addition, the fully owned Haverhill site was independently valued in 2022 at ~£5.4m. Much higher than the current book value of ~£1.7m.

Risks

A continued and protracted downturn in UK housebuilding would hurt both divisions. The most affected would be Mechanical Ventilation, which is already suffering from the current slowdown. Although difficult to predict, housing starts within the UK seem to be at a cyclical low point and there are signs of a recovery (covered in my last article on Nexus Infrastructure).

Secondly, there’s a risk that Titon’s margin improvements fail. If so, given the current cost cutting measures, I think shareholders can reasonably expect a return to historical Operating Margins of ~6%. Or worst case, continued losses that ultimately results in a liquidation. Given the current price and asset value, it’s unlikely that either outcome would result in a large realised loss for shareholders.

In summary, there’s plenty to like. I like the removal of the Korean business, which has been a drain on profitability and resources. I also like the new board, who seem much more friendly to minority shareholders. Granted, it’s taken a few decades, but Titon is finally in the best position to maximise value.

All we need to do now, is wait!

Disclaimer. This article is for informational purposes only, and should not be seen as investment advice. Please do your own research before investing in any company mentioned.

Only just found your write up Adrian - an excellent overview of the potential here.

Nice write-up, thanks for sharing.