Is a liquidation coming? And if it does, will a sale fetch multiples of the current share price? These are the two questions currently being asked by every shareholder of Centaur Media.

If the answer to both is a solid yes (spoiler alert! I think it is!) - this special situation is going to be a very profitable investment!….

Centaur Media is a UK based holding company. Listed on the London Stock Exchange in 2004, it was originally an ‘old-school’ media conglomerate. By old-school, I mean it published industry magazines, the physical paper version. These provided news and insights on a broad range of sectors from construction and engineering, to finance and marketing.

Originally, the business model was based on controlled circulation, whereby magazines were either free or very cheap for qualifying readers. Centaur Media then sold either advertising, recruiting services, or industry events.

Over time, this model has shifted. As print magazines transitioned online, free digital content wasn’t able to generate the same advertising revenue.

To combat this, Centaur Media began investing in better digital content. Instead of giving it away for free, this premium content was brought under a paywall and sold on subscription basis. Ideally, producing a growing stream of reoccurring revenue.

In 2018, a strategic review identified the marketing and legal sectors as having the strongest prospects for this new approach. All the other brands were divested, including the financial services division and the engineering portfolio.

Centaur media now comprised just two divisions:

The Lawyer. Contains a legal publication of the same name.

Xiem. Contains the historic marketing brands consolidated into a single segment (Apparently Xiem stands for excellence in marketing).

To lead this change, a new CEO was installed - the charismatic former CFO, Swag Mukerji.

For those who have followed Overlooked and Undervalued for a while, you’ll probably know that I’m highly sceptical of promotional management teams with eloquent growth strategies.

If you’re unsure what this means in practice, take a look a Centaur Media’s last few annual reports.

The first obvious warning sign is the heavy use of adjusted accounting. The second, is the clever marketing language used to sell the company’s strategy to investors.

This began with the Margin Acceleration Plan or MAP 23 - something about reaching Adjusted EBITDA margins of 23% by 2023. (Oh please!) More recently, there was Build Invest Grow or BIG 27 strategy - the idea of growing repeat and recurring revenues to some arbitrary number by 2027. Stop, just please stop…..!

And finally it has. I’d guess that like me, the largest shareholder, Harwood Capital has also had enough. These rather catchy targets turned out to be a great marketing tool, but nothing more. Ultimately, clever language didn’t improve sales growth and so in December 2024, the CEO Swag Mugahi resigned.

It was at this point that I became interested. The painfully promotional strategies were finished and the share price was cratering. For those willing to look past the marketing slogans and the adjusted accounting, you’d be pleasantly surprised to find a few genuine businesses.

The Lawyer (roughly 1/3 of consolidated sales)

This is Centaur Media’s crown jewel asset.

The Lawyer has provided legal news and commentary across the UK since 1987. However, it’s been the past five years that have been a standout success. It’s been the shining example of a successful transformation from Centaur Media’s old business model, to its new one.

To drive premium content sales, The Lawyer’s management team focused on creating unique and valuable content.

Firstly, there’s the Litigation Tracker. Launched in 2017, this unique data source draws from English civil court judgments to shows the most active firms for different types of litigation. It also benchmarks litigation lawyers, in a similar way that corporate lawyers use M&A league tables.

Secondly, there’s Practice Analysis. This tool tracks the Top UK and US law firms, examining the size, shape, and efficiency of each practice. It makes comparisons to competitors and helps spot industry trends. It also provides information on the latest lawyer moves and promotions.

Over the past five years, The Lawyer has consistently attracted subscribers from over 90% of the top 50 UK and top 50 US law firms in London. Industry giants such as Allan and Overy, Clifford Chance, Freshfields, and Linklaters.

These firms pay around £50k per year for a news subscription and double that price if they want the combined service, which includes market data and analysis. A large majority pay for the more expensive combined service, which is growing in popularity. Last year, renewal rates were over 100% as subscribers expanded the cost of their current subscriptions.

As a standalone business, The lawyer has superb economics. Subscriptions are paid upfront, working capital is negative, and Content sales have been consistently growing alongside Operating Margins.

Importantly, the recent slowdown in consolidated performance has not affected The Lawyer. A trading update from October 2024 stated that subscriptions have continued to improve in the second half. I’d therefore expect growing sales and profits when the FY 2024 results are announced in March.

Xiem (roughly 2/3 of consolidated sales)

Xiem has gone through a similar digital transformation to The Lawyer. Alongside investing in Premium Content, this division has rapidly grown a second revenue stream based on Training and Advisory. Together, these represent over 90% of Xiem’s revenue.

Xiem is made up of 9 marketing brands. Many are comparatively small and hardly contribute to consolidated results. And so in the interests of time, I’ll introduce you to the largest.

Marketing Week’s Mini MBA (Training and Advisory)

MW Mini MBA is Centaur Media’s biggest brand. As a standalone business, it’s a similar size to The Lawyer and generates ~40% of Xiem’s sales (or ~£10 million per year).

MW Mini MBA is an e-learning platform that provides three online courses - each costing around £2,000. The Mini MBA in Marketing and the Mini MBA in Brand Management were created in 2016. A third course, the Mini MBA in Management, was added in 2023.

Mark Ritson, a well-known marketing professor, is the Dean of the MW Mini MBA and created the original two courses. The later course, the Mini MBA in Management, is led by Helen Edwards, a professor at London Business School.

These Mini MBA’s distill the core marketing modules of a full MBA programme into a 12-week course. They are aimed at marketing professionals, who want to improve their knowledge in order to transition into more senior roles.

The business has grown rapidly. Since its creation in 2016, student numbers rapidly rose to ~2,500 in 2019 and then to ~6,000 last year. In total, there’s now over 32,000 alumni.

Econsultancy (Premium Content and Training and Advisory)

EConsultancy provides platform based learning and bespoke advisory services to large companies.

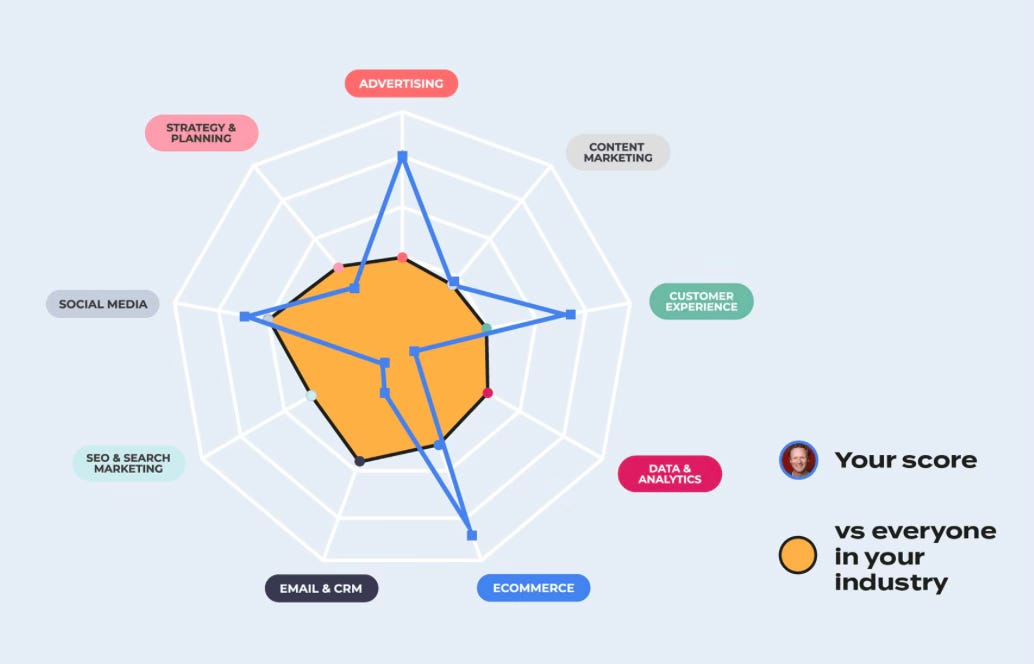

Aimed at new joiners, Econsultancy helps managers identify the digital marketing and e-commerce skills that are missing from their teams. An online platform then provides over 250 courses to up-skill employees towards a common level of competency.

Subscribers get access to a digital skills index. A useful tool that tracks employees progress, benchmarking them against the wider organisation and 35,000 other industry professionals.

Yearly subscriptions to the platform cost ~£1K per user and clients currently include industry giants such as Sky, Specsavers, Jaguar Land Rover, Unilever, and the John Lewis Partnership. Generally, subscribers sign up for multiple years.

Other smaller brands:

Influencer Intelligence (Premium Content). A subscription platform that connects businesses with social media influencers.

Fashion and Beauty Monitor (Premium Content). An online directory used by brands, media, and PR companies. Fashion and Beauty Monitor has the contact details of 60,000 people within the fashion and beauty industry.

Oystercatchers (Training and Advisory). An advisory business that helps senior marketing managers select marketing agencies.

Understanding Xiem’s financial results is not straightforward. Each business is consolidated into two main revenue streams:

Training and Advisory. The main contributor is Marketing Week’s Mini MBA (with ~£10 million in sales), followed by EConsultancy’s advisory business, and then Oystercatchers.

Premium content. The main contributor is EConsultancy’s platform business, followed by Influencer Intelligence, and Fashion and Beauty Monitor.

Taken together, these businesses earn decent Operating Margins of around 10% to 20% on average.

However, there’s more sales cyclicality than The Lawyer. Especially, within those brands reliant on shorter term advisory i.e. EConsultancy’s advisory business and Oystercatchers. Both saw a significant drop in the last twelve months as larger companies reduced their marketing budgets.

Is a liquidation coming?

Given the situation, I think it’s highly likely.

The CEO has resigned and instead of being replaced by another CEO, there’s been an Executive Chair appointed to run the day to day operations.

This new Chair, Martin Rowland, has a track record of divesting businesses. He was recently appointed to the board of another Harwood Capital investment - Carrs Group (LSE: CARR). And almost immediately after becoming Executive Director of Transformation, the largest of the company’s divisions was put up for sale.

I expect similar announcements to follow at Centaur Media. According to the latest update, Martin Rowland will “lead a review of Centaur's business operations and strategy” with the aim to “realise Centaur's potential and to maximise shareholder value”.

A liquidation decision will be made easier by Centeur Media’s structure. Each individual business (or brand) operates separately. There are also limited synergies between brands, alongside an expensive layer of central costs - amounting to over £3 million per year.

With no CEO and no new growth strategy, a liquidation seems to be the only feasible option.

Will the sum of the parts fetch multiples of the current price?

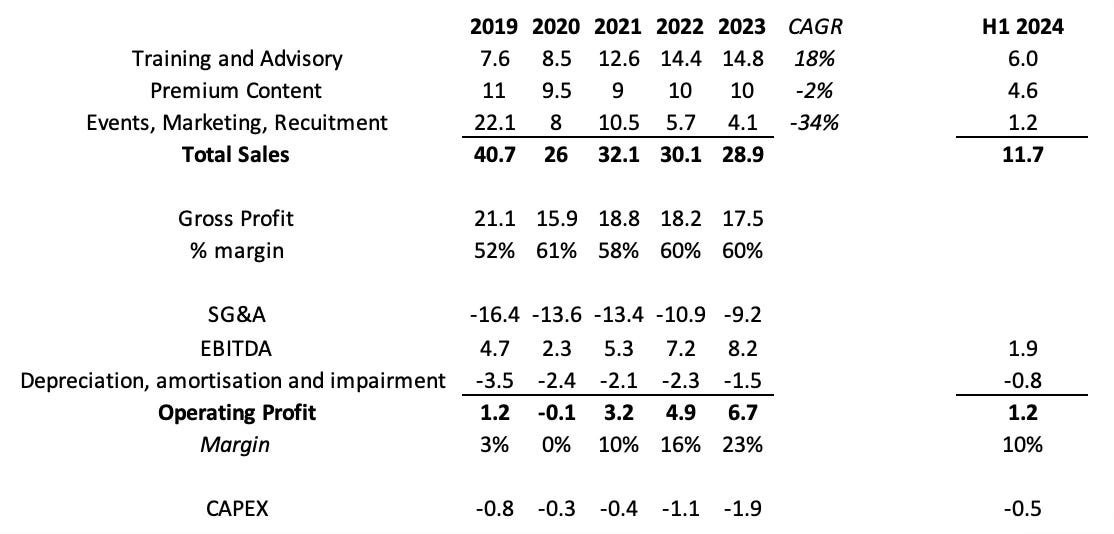

At £0.30 per share, Centaur Media’s current Market Capitalisation is ~£45 million. With ~£10mm in Net Cash, the Enterprise Value is ~£35 million. Consolidated Sales for the year ending 31st December 2024 are expected to be ~£35 million with an Operating Profit (excluding central costs) of ~£7 million.

Removing central costs, Centaur Media is priced at around five times FY 2024 Operating Profits. For this, you get the three larger Business intelligence/e-learning platforms (The Lawyer, Marketing Week’s Mini MBA and Econsultancy), alongside seven smaller marketing brands.

But what are they actually worth? Well, selling each for ten times Operating Profit seems plausible and would earn us double the current price. At fifteen times, we’d earn triple. Given the business quality, especially at The Lawyer, multiples could be even higher.

The low price, the obvious quality, and the current catalysts mitigate many of the potential risks. However, investors must be comfortable looking past the current headwinds, which have caused consolidated sales and profits to rapidly decline.

To do this, I’ll be following the two largest and most valuable businesses (The Lawyer and Marketing Week’s Mini MBA). Each has sales of ~£10 million. Both are still growing, with subscriptions that continued to improve in the second half of 2024. The sale of either business would realise a large part of Centaur Media’s value.

I’ll be monitoring the situation closely and will try to keep you updated. As always, thank you for your interest and your time.

(So far, I’ve bought a starter position, amounting to ~5% of my portfolio.)

Disclaimer. This article is for informational purposes only, and should not be seen as investment advice. Please do your own research before investing in any company mentioned.

Consolidated Results and Useful Links:

Each business was introduced at the most recent Capital Markets Day. If you’re interested, it’s well worth a listen:

Thank you for the great, work. I can't find transcripts of the earnings calls on any platform. Any material updates since you posted this one?

You're very kind and thank you for following along.

Unfortunately, the company doesn't conduct any publicly available investor calls, hence no transcripts. The most recent public event was the 2024 Capital Markets day in April last year, the video of which is at the bottom of my Substack post. If you've not already done so, this is worth watching and gives you a good background on all the different brands.

I provided a short update when the prelims were released on the 19th March 2025. This is available in my chat (https://substack.com/chat/1611238).

Ultimately, no big changes to my original writeup and we're still waiting for an update of the 'Strategic Review'.

Hope that helps!